Green Coffee Market Size

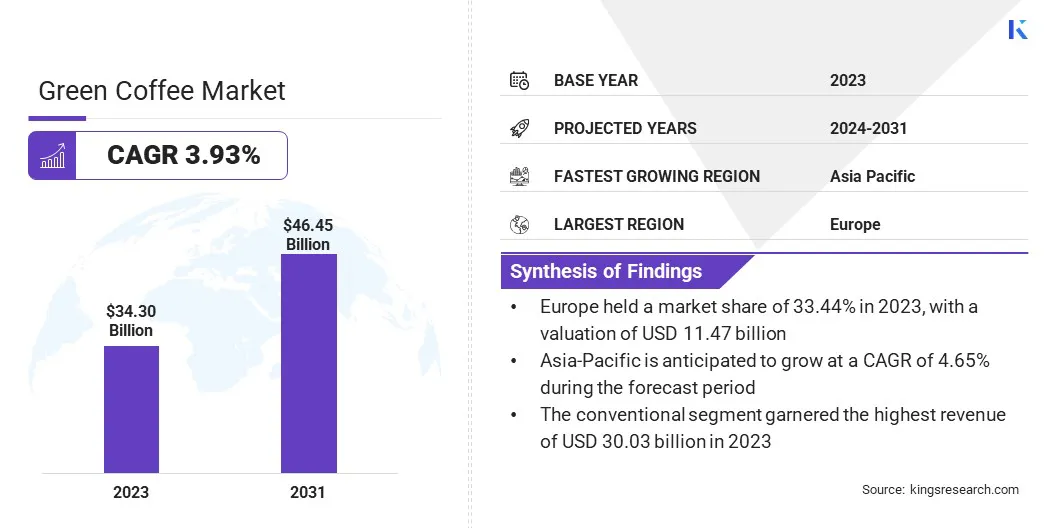

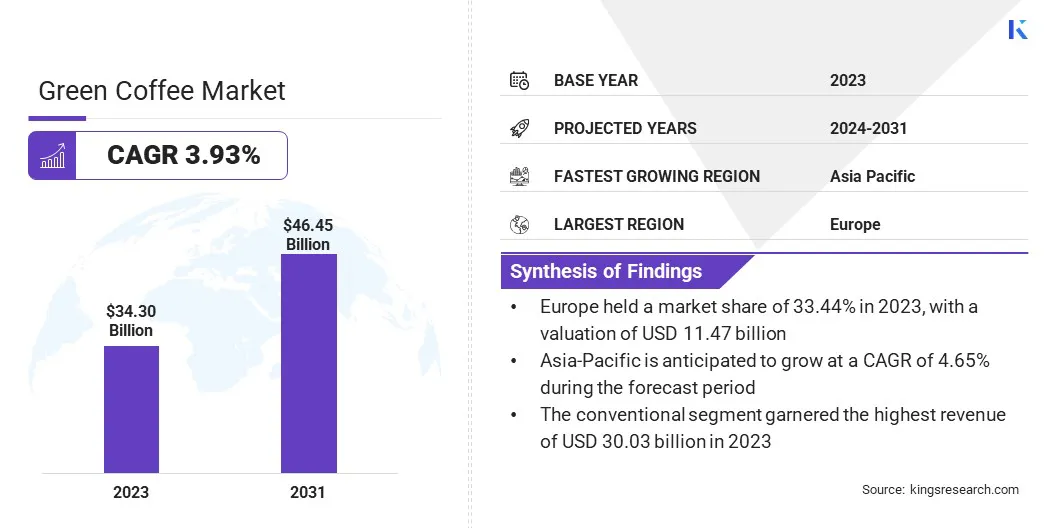

Global Green Coffee Market size was recorded at USD 34.30 billion in 2023, which is estimated to be at USD 35.48 billion in 2024 and projected to reach USD 46.45 billion by 2031, growing at a CAGR of 3.93% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Atlantica Coffee, Belco, Green Coffee Co., Hamburg Coffee Company Hacofco mbH, Louis Dreyfus Company, Napco Inc., Nestlé SA, Neumann Gruppe GmbH, Nordic Approach AS, Tata Coffee, and others.

The growth of the green coffee market is primarily driven by increasing consumer demand for specialty coffee, which emphasizes unique flavors and high-quality beans. The rise of health-conscious consumers who seek natural and unprocessed products contributes significantly to this growth, given that green coffee is often marketed for its potential health benefits.

Additionally, the growth of e-commerce platforms facilitates wider distribution and accessibility of green coffee products. The expanding café culture, especially in emerging markets, continues to fuel demand. Moreover, the growing interest in sustainable and ethically sourced coffee beans influences consumer preferences, fostering the purchase of green coffee, often sourced from eco-friendly and fair-trade sources.

The green coffee market encompasses the trade of unroasted coffee beans, which are integral in the production of various coffee beverages. It serves as a critical segment within the broader coffee industry, catering to roasters, retailers, and individual consumers. The market exhibits steady growth, propelled by a blend of traditional and innovative channels. Specialty coffee shops and home brewing enthusiasts are significant consumers of green coffee beans.

The market is characterized by a diverse range of suppliers, encompassing small-scale farmers as well as large cooperatives, thereby ensuring a broad supply chain. The market spans major coffee-producing regions such as Latin America, Africa, and Asia, with North America and Europe emerging as prominent importers.

- According to the USDA, Brazil led coffee production in the year 2023-2024, accounting for roughly 40% of the global coffee production.

Green coffee refers to the raw, unroasted coffee beans that are processed and prepared for roasting. These beans are the seeds of the Coffea plant, primarily Coffea arabica and Coffea robusta. Green coffee retains its natural chlorogenic acids, which are believed to offer health benefits, differentiating it from roasted coffee.

The market includes the entire supply chain, including cultivation, harvesting, processing, and distribution. Green coffee is a key raw material for coffee roasters and is available in various grades, which are determined by factors such as origin, bean size, and defect count. This market plays a vital role in the global coffee industry, influencing the pricing, quality, and availability of the final roasted coffee products.

Analyst’s Review

The green coffee market shows promising growth, fueled by key efforts from manufacturers to meet evolving consumer demands. Major manufacturers are focusing on sustainability by implementing initiatives that incorporate regenerative agriculture techniques, eco-friendly farming, and fair-trade practices. New product launches, such as innovative coffee extracts and ready-to-drink beverages, are diversifying the range of available options.

To stay competitive, manufacturers should prioritize quality, transparency in sourcing, and product innovation. Collaborations with coffee farmers to ensure ethical sourcing and invest in sustainable practices are essential to maintain their presence among existing consumers. Additionally, leveraging digital platforms for marketing and distribution is likely to help manufacturers enhance market reach and brand visibility.

Green Coffee Market Growth Factors

The rising consumer interest in health and wellness has resulted in consumers increasingly prioritizing natural and minimally processed products. This is leading to the rising popularity of green coffee due to its perceived health benefits.

Green coffee, rich in chlorogenic acids, is believed to aid in weight management due to its robust antioxidant properties. This health-conscious trend is prompting more consumers to incorporate green coffee into their diets as a supplement or a brewed beverage. In response to this rising demand, producers and retailers are expanding their product lines to include green coffee, thereby supporting market growth.

The volatility of coffee bean prices, influenced by factors such as climate change, pests, and political instability in coffee-growing regions, presents a key challenge that impacts both the profitability for farmers and the stability of supply for buyers.

To overcome this challenge, stakeholders are adopting sustainable farming practices and investing heavily in advanced agricultural technologies. Techniques such as precision farming, pest-resistant crop varieties, and improved irrigation methods help mitigate risks associated with environmental factors.

Additionally, fostering long-term partnerships and fair-trade agreements helps provide financial stability for farmers, thereby ensuring a more consistent supply chain and reducing the impact of price volatility.

- According to World Coffee Research, current consumption trends and the negative impacts of climate change on coffee production will result in a shortage of approximately 35 million bags of the robusta variety by 2040.

Green Coffee Market Trends

The increasing demand for specialty coffee is majorly attributed to the growing consumer preference for high-quality, single-origin coffee beans with distinct flavors. This trend is further fueled by an increasingly knowledgeable consumer base that values the unique characteristics and narratives associated with their coffee choices.

Due to this, there is a major focus on transparency in sourcing of coffee, with producers and retailers highlighting details regarding the origin, processing methods, and farmer relationships. This is leading to a rise in direct trade practices, where coffee roasters buy beans directly from farmers, ensuring better quality control and fostering sustainable practices within the industry.

Sustainable and ethical practices are increasingly influencing the green coffee market. Consumers are becoming more environmentally conscious, seeking products that align with their values of sustainability and social responsibility. This is prompting coffee producers to adopt eco-friendly farming practices, such as organic farming, agroforestry, and water conservation methods.

Certifications issued by global bodies such as Fair Trade and Rainforest Alliance are gaining importance, providing consumers with assurance regarding the ethical sourcing of their coffee. Additionally, there is a growing emphasis on reducing the carbon footprint throughout the supply chain, spanning from agricultural production to final consumption, through the promotion of initiatives such as carbon-neutral shipping and biodegradable packaging. This trend is reshaping the market landscape, with a pronounced emphasis on sustainability and ethical standards.

- The Sustainable Coffee Challenge is a key global movement conceived by Conservation International in collaboration with Starbucks. Initially launched with 15 partners, it has since expanded to encompass 155 international partners. The aim of the challenge is to incorporate sustainable practices in the global coffee supply chain and find solutions for coffee farmers and producers.

Segmentation Analysis

The global market is segmented based on nature, type, end-use, and geography.

By Nature

Based on nature, the market is categorized into organic and conventional. The conventional segment led the green coffee market in 2023, reaching a valuation of USD 30.03 billion. This expansion is primarily due to the widespread availability and cost-effectiveness of conventional coffee as compared to organic coffee.

Conventional farming methods generally result in higher yields and lower production costs, making conventional green coffee more accessible to a broad range of consumers and businesses. Additionally, many established coffee brands and large-scale producers flavor conventional beans due to their consistent quality and supply reliability. Despite growing interest in organic products, the conventional segment remains dominant because of these economic and supply chain efficiencies.

By Type

Based on type, the market is segmented into arabica and robusta. The arabica segment secured the largest green coffee market share of 54.56% in 2023. The segment is experiencing robust growth due to its superior flavor profile and higher demand among specialty coffee consumers.

Arabica beans are known for their mild, aromatic taste and lower caffeine content, which makes them more appealing to premium coffee markets and discerning consumers. The increasing popularity of specialty coffee shops and the growing trend of at-home gourmet coffee brewing are driving the demand for Arabica beans.

Additionally, regions known for high-quality Arabica production, such as Latin America and Ethiopia, are enhancing their cultivation techniques to meet global quality standards, further boosting segment expansion.

By End-Use

Based on end-use, the market is classified into roasted coffee, coffee extract, and soluble/instant coffee. The coffee extract segment is poised to witness significant growth at a CAGR of 5.08% through the forecast period (2024-2031). This growth is driven by the rising popularity of coffee-based beverages and the increasing use of coffee extracts in food and beverage applications.

Coffee extracts are valued for their concentrated flavor and versatility, making them ideal for a variety of products such as ready-to-drink beverages, desserts, and flavorings. The health benefits associated with coffee extracts, including antioxidant properties, are also attracting health-conscious consumers. Additionally, advancements in extraction technologies are improving the quality and potency of coffee extracts, further supporting segment growth.

Green Coffee Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Green Coffee Market share stood around 33.44% in 2023 in the global market, with a valuation of USD 11.47 billion. This dominance is attributed to the region's strong coffee culture, characterized by a high consumption rate of specialty and premium coffees. European consumers exhibit a sophisticated palate, preferring high-quality Arabica beans and supporting the specialty coffee sector.

Additionally, Europe hosts numerous international coffee trade fairs and has well-established supply chains connecting major coffee-producing countries. The presence of leading coffee roasters and brands headquartered in Europe is further impelling regional market growth. Additionally, the region's emphasis on sustainable and ethically sourced coffee aligns with consumer preferences, reinforcing its leading position in the market.

The Asia-Pacific green coffee market is slated to expand substantially at a CAGR of 4.65% through the review timeline. This growth is driven by rising disposable incomes and an expanding middle class with increasing exposure to global coffee trends. The region's growing urbanization and café culture are propelling coffee consumption, particularly in countries such as China, India, and Japan.

Additionally, the Asia-Pacific region is seeing a surge in specialty coffee shops and a growing preference for premium coffee products. Investments in coffee production and processing infrastructure in countries such as Vietnam and Indonesia are also boosting the domestic market growth, enhancing both supply and quality.

Competitive Landscape

The green coffee market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Green Coffee Market

- Atlantica Coffee

- Belco

- Green Coffee Co.

- Hamburg Coffee Company Hacofco mbH

- Louis Dreyfus Company

- Napco Inc.

- Nestlé SA

- Neumann Gruppe GmbH

- Nordic Approach AS

- Tata Coffee

Key Industry Developments

- April 2023 (Expansion): Sucafina opened its subsidiary Sucafina Guatemala, expanding its reach in sustainable coffee sourcing. This move aligned with Sucafina's goal to provide diverse coffee qualities globally while enhancing operational efficiency and knowledge sharing. The new facility was developed as a convenient hub for suppliers and customers.

- March 2024 (Expansion): Luckin Coffee initiated the trial run of its inaugural green coffee bean processing facility in Baoshan City, Yunnan Province. With this move, it aimed to refine its supply chain and ensure better control over coffee bean quality throughout production. The plant featured advanced technology from Brazil and Colombia, enabling efficient coffee fruit processing. The facility boasts of an annual capacity of 5,000 tons, and integrates eco-friendly practices, thus, achieving zero wastewater discharge and reduced emissions, aligning with their sustainability goals.

The Global Green Coffee Market is Segmented as:

By Nature

By Type

By End-Use

- Roasted Coffee

- Coffee Extract

- Soluble/Instant Coffee

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America